Black Swan Getting Ready to Fly

Written by Charles Biderman, published in THE MARKET on the 14th of December, 2020

Suckers Market: There are increasing signs that the stock market boom is nearing its peak. Retail investors are speculating wildly with options and believe that they cannot lose money with stocks. At the same time, companies are throwing more and more stocks onto the market. A sure recipe for a crash.

Whenever I gave an investor talk before 2009, I always started with a similar question to the audience: What is the stock market designed to do the way it operates? Another version of the question: What is the design purpose of the stock market?

Audience answers were usually from the investors point of view: to invest for retirement, for college tuition and the like.

I eventually coaxed the correct answer: The stock market is designed to separate investors (AKA Suckers) from their money ongoingly, yet leave them with a smile so they keep coming back for more. Data shows over 80% of day traders lose money, and other traders keep investing while losing.

Today, the stock market continues to make record highs after record highs. Why? Biderman’s Liquidity Theorom (yes, I made it up) says more money has been chasing fewer shares. Remember: All there is in the stock market are shares of stock and money flows in and out of broker accounts and ETFs and other funds.

Accordingly, a bull market is when more money chases the same amount or fewer shares. A bear market is when more shares is chasing less money.

This year, central banks have been supporting equity markets by flooding the banking system with trillions of dollars of newly created money. Ultimately, the flood of money has been pushing stock and bond prices higher.

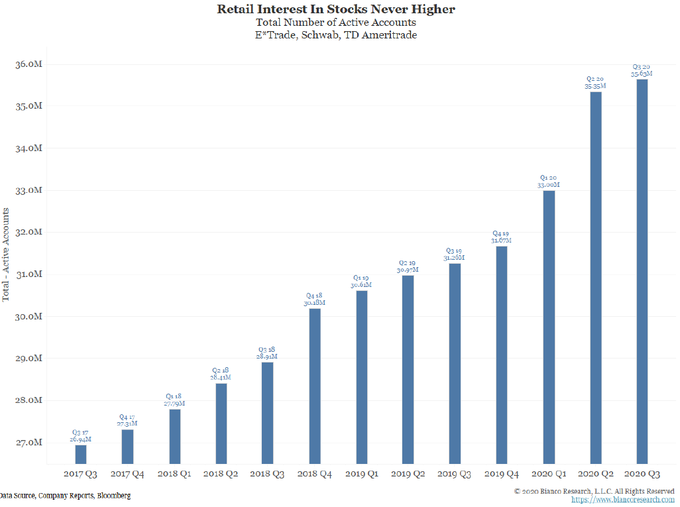

Individual Investors Are Huge Buyers Now

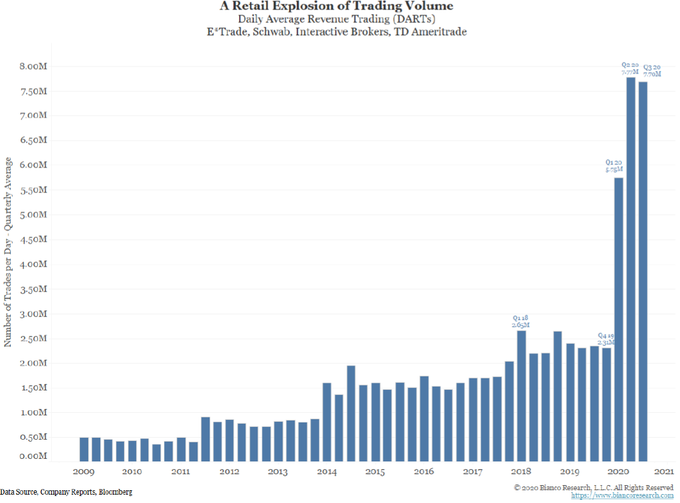

Then, there are the actions of individual investors. And right now, individual investors firmly believe you cannot lose money in the stock market. Helping out are the Robinhoods of the world allowing investors to purchase fractional shares and single options with no commission.

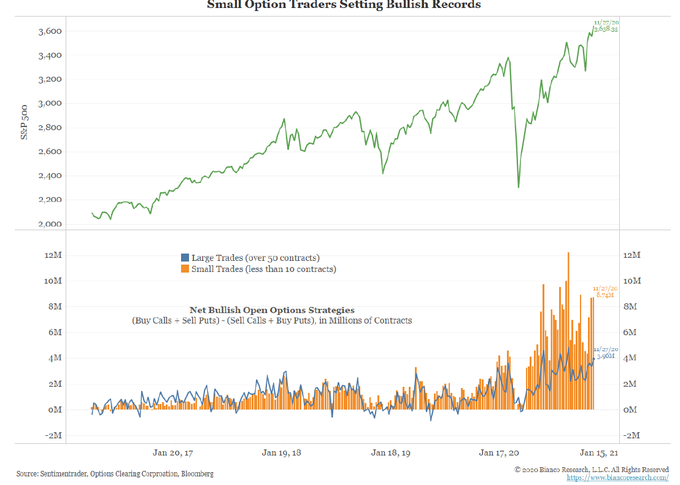

And, if stock prices can never go down, leveraging by buying call options makes sense. If Tesla is going to a million dollars a share, buying a few options can create huge returns. That is why odd lot option trading has exploded to record levels.

Indeed, individual investors are selling huge amounts of Index Exchange Traded Funds and mutual funds and apparently putting the money into stocks and options.

Here’s a telling statement from Jim Bianco of Bianco Research: The public’s shift from mutual funds and ETFs towards speculating in individual stocks and options continues without pause. Last week’s options volume boomed to a new record. All signs suggest the mania is making new peaks.

Obviously, putting all your money into stocks are actions one would take if you believed there is no downside risk in the markets.

By this point, if you’ve kept reading, you realize I am describing a major market top. All major market tops occur after investors have pumped all their available money into the market.

What also occurs at major market tops is that companies start selling as many newly created shares to the suckers before the window closes. Right now, and for the last few months companies have started selling more shares than they are buying back from the public.

Company selling, not buying is a major shift. Between 2011 and 2019 US public companies bought back $6 trillion of their shares more than all new Initial Public Offerings, secondaries and insider selling.

Perhaps surprising, over that same time period individual investors put no ($0) new money into the stock market. Outflows from US equity mutual funds equaled inflows into US equity Exchange Traded Funds.

Remembering Biderman’s Liquidity Theorem: $6 trillion new money from public companies plus $0 from individuals; chasing fewer shares means the stock market is up around $30 trillion in value over that time.

Much Different Now

Now, companies are lining up to sell new shares to the public. Another sign of a market top is when individual investors are willing to invest in blind pools. Blind pools were a quick way for suckers to get into the 1920’s market. Now, 100 years later, over 100 blind pools called Special Acquisition Companies (SPAC) will raise maybe as much as $100 billion this year from the gullible public.

To summarize, after not investing new money for a decade, in 2020 individual investors have gone hog wild buying any kind of stock or option because they know they cannot lose.

To reiterate, the design purpose of the stock market is to separate the suckers from their money. The Securities Industry Association says the design purpose of the stock market is to raise money for industry.

Industry is lining up to sell as many new shares before the public eventually says «no mas». The only question is when.

If the central banks keep printing, the game could continue for months longer. But in my humble opinion, the Black Swan that eventually will crash this market is getting ready to take off.

I have no idea as to what the Black Swan could be. Maybe inflation, maybe a US dollar collapse, perhaps a COVID related economic catastrophe. Who knows? But I do know a Black Swan is coming.

Like I said before. What I tell any investor who asks: Sell half your equities now and hope I am wrong.

Charles Biderman