Crypto Mania: A Money Printing Phenomenon

Written by Charles Biderman, published in THE MARKET on the 16th of May 2021

The unprecedented stimulus measures are driving speculative stocks and cryptocurrencies sky high. A prime example is the show Elon Musk is putting on with Dogecoin. But the impact will be all the harder if the Tesla CEO, like Icarus, gets too close to the sun.

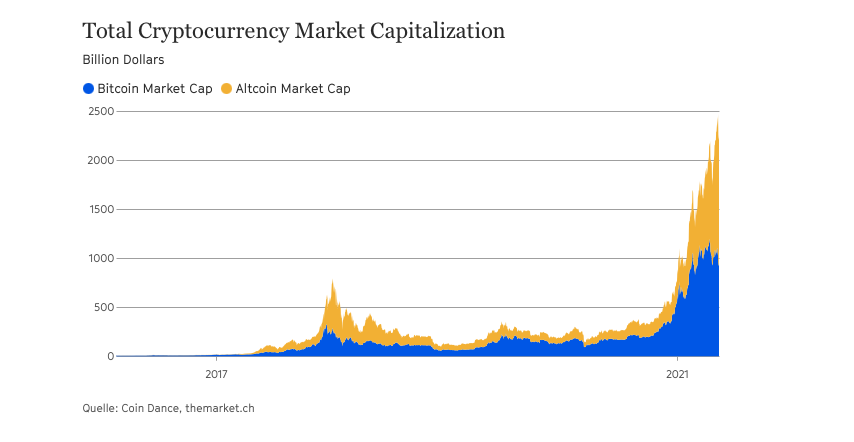

All cryptocurrencies, based upon recent trades, are valued at around $2.5 trillion, up from $300 billion at the start of the pandemic in March 2020, and basically $0 before 2017. Many people have made a lot of money on paper from playing the crypto mania, even though most have no idea what it is they actually own.

A cryptocurrency is nothing but a string of software. Cryptocurrencies have no inherent value in and of itself. Cryptocurrency is a belief, nothing more nothing less. All a crypto is worth is what the next buyer is willing to pay for it; assuming you do not lose your passcode.

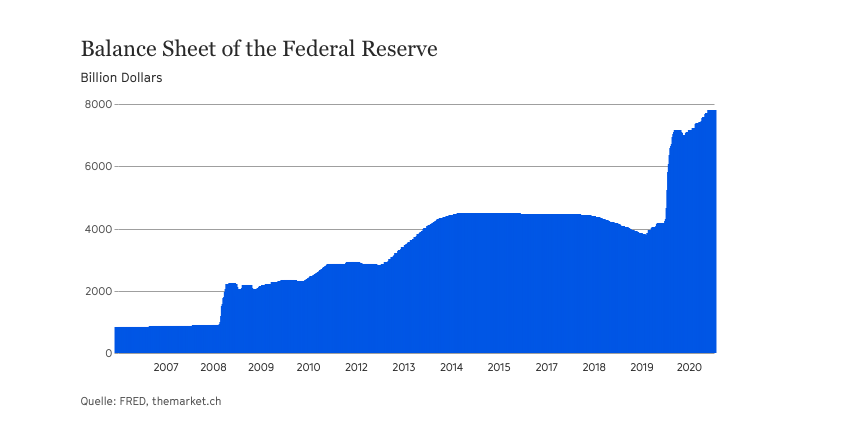

Beginning with the 2008-9 market crash, the US Fed bought the newly printed money created by the US Treasury; initially to bail out the banking system so no crooked banker had to go to jail. And then the Federal Reserve began buying up the newly printed US Treasury bonds to fund the US current account deficit. In other words, the US paid the balance of its day-to-day bills by printing money.

Since the 2009 bailout, the Fed added around $3.5 trillion dollars of newly printed money to its balance sheet through 2016. Around that time, I was screaming in print, that the US economy could never grow fast enough in the foreseeable future not only to pay off the trillions in US debt owned by the Fed, but the trillions of dollars of guaranteed future payments to social security recipients, Medicare, and government employee pension and healthcare benefits.

Put differently, the US would be declared insolvent if it were a public company. So smart guys and gals reasoned that a new currency not dependent upon the government had to be created.

Hence the birth of Bitcoin that can operate outside of the current financial system. As mentioned, all the many versions of crypto today about total $2.5 trillion in value, including the «hustle» Dogecoin.

Total Cryptocurrency Market Capitalization

The Law of Supply and Demand

Remember supply and demand? Huge amounts of newly created money to fund an ever-increasing budget deficit created a perceived need for an alternate currency. And, huge amounts of new money are creating an ever-rising price of cryptocurrencies.

As for the big US financial picture since 2011, no new money has gone into stocks from individual investors up until this year. All the new money since 2011 that went into US Equity Exchange Traded Funds was roughly equal to all the money leaving US Equity Mutual Funds.

So how did the US stock market go up four times since 2011? US public companies simply gave back to investors $6 trillion in cash by buying back outstanding shares and giving investors more money with which to chase fewer shares.

Biderman’s Liquidity Theory says a Bull Market is more money chasing an amount of financial assets that is growing more slowly. For example, since the pandemic hit last March, the Federal Reserve bought a whopping roughly $4 trillion of newly printed Treasury bonds.

Balance Sheet of the Federal Reserve

More money chasing relatively fewer stuff to buy, and the price of all that stuff soared. Stock prices went to the moon. For that to happen, valuations – the relationship between stock price and cash flow generation – stretched big time.

Some stocks bubbled to ridiculous levels compared with cash flows. Tesla is a prime example of a stock that can never make enough money to justify today’s price.

Yet even more bubblecious are those assets without any relationship to cash flows. Here, cryptocurrency is a prime example. No surprise that Tesla’s Musk is a huge supporter of Crypto. Indeed «Icarus» Musk is currently one of the richest people on the planet – on paper.

The Next Black Swan

Government money printing has contributed over 30% of the personal income of all Americans so far this year. The Treasury sends out checks. And many people invest a portion of that money into crypto and stocks.

Many politicians and individuals believe that the US Government should just keep on printing money and giving it to Americans. Thus if $2,000 a year is good to give away, why not $1 million? Imagine how high Tesla and Dogecoin could sell at then?

On the other hand, if Tesla and cryptos have surged at the same time as Government giveaways have spiked, what happens when government printing stops? Or even worse, contracts?

Biderman’s Liquidity Theory says a bear market is when more assets are chasing less money. If there is less new money to buy increasing assets, asset prices have to drop.

Usually bear markets end when the price of the asset is less than the value of the asset as a cash flow generator. But what about companies that have no cash flow – such as Tesla – selling at an infinite multiple of «belief»?

Or even worse: What happens to cryptocurrency prices when there are no buyers of an asset with no intrinsic value?

Icarus crashed after he flew too close to the sun and his wings melted. I predict a similar end to Mr. Musk. I believe his recent SNL appearance will be magazine cover for decades to come in highlighting the current mania.

As I said in a recent op-ed entitled Black Swan Getting Ready to Fly, for as long as new money keeps being printed stock and crypto prices will keep rising. But when the printing presses stop, what will crypto and companies with no real cash flow be worth?

In other words, the next Black Swan.

Charles Biderman